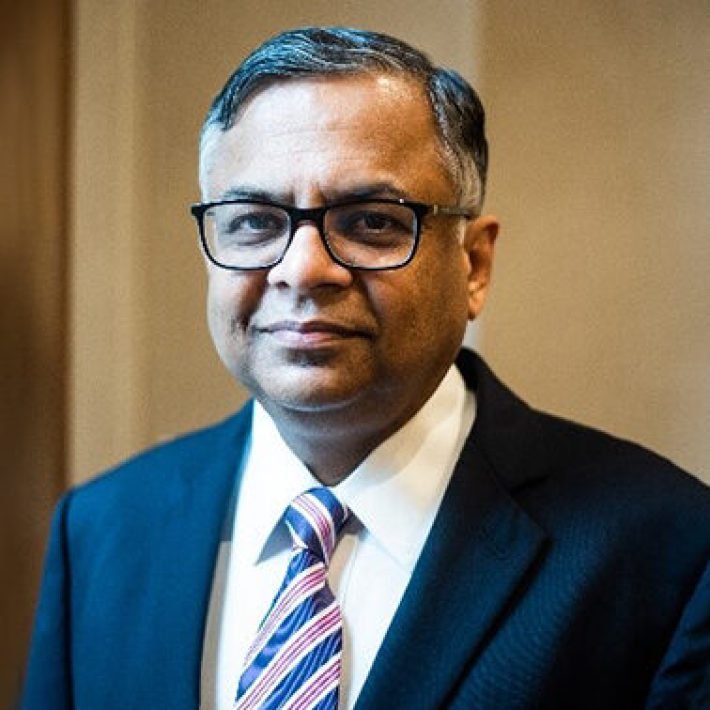

Boman Rustom Irani, President, Confederation of Real Estate Developers’ Associations of India (CREDAI) (national), and CMD Rustomjee holds forth on the heightened optimism in the real estate sector, and the desired improvements to bring change in favour of the industry.

By Nichola Marie

According to reports from agencies, Indian real estate has been performing very well this year. What is driving this positive sentiment?

There are several factors behind this resurgence in property registrations in the last three to four quarters. It is a mix of a conducive lending environment, pentup demand from Covid and homebuyers’ inclination to buy as opposed to renting – as many keep opting to buy bigger homes. Real estate, as always, continues to provide the best ROI on investments, as we have been seeing for decades. We expect this momentum to continue for the foreseeable future at the very least. India’s favourable economic prospects amid global geopolitical conditions have heightened optimism in the real estate sector, further driving the positive sentiment.

How do you see long-term growth for the real estate sector and the factors powering this growth?

The Indian real estate sector will continue to be one of the strongest pillars of the Indian economy. It is highly anticipated that when India hits the $5 trillion GDP mark, $1 trillion will be contributed by the realty sector. With robust demand, and ground-breaking government programmes and initiatives, there is a very strong platform that currently exists that will catapult both sectoral and economic growth. This will also elevate over 250+ ancillary industries that are directly or indirectly dependent on real estate in India.

What major trends are bound to influence the real estate sector in the future?

Going forward, the Indian real estate sector will be significantly influenced by sustainability measures, technology integration, innovation and the increasing demand for green homes. Rapid urbanisation in Tier 2 and 3 cities will also drive the development of more housing, hospitality and commercial development. In the short to midterm, we believe that there will be a continued appetite for larger and more luxurious spaces while the need for affordable housing will also remain high, which augurs well for holistic sectoral growth. The technological integration aspect of buildings (smart homes, virtual tours, and digital transactions, etc.) also brings a lot of opportunity as it not only makes one’s lifestyle more convenient but also creates a path for sustainable change. Hence, staying adaptable to these trends is crucial for success in the evolving real estate market.

How do you see property technology (proptech) and digital house hunting impacting the real estate industry?

Proptech is revolutionising the Indian realty market by offering solutions to problems in real-time. This has come in handy to real estate buyers by supporting them from house hunting to selling the property, enhancing transparency and ease of buying as a direct consequence. With respect to developers, proptech has been a gamechanger as it has become a direct connection between the buyer and the seller, empowered by trust. We expect more technological-led initiatives to become the norm in a constantly evolving Indian realty landscape.

Any government regulations, schemes and offers which impact the sector that you hope to see a change in favour of the industry?

There is an urgent need to implement ‘transitional policies’ which provide stakeholders, and especially developers, reasonable time to adjust to the new normal. There should be a thorough process, including consultations with different stakeholders, to ensure everyone’s on the same page and the transition to a new policy is more streamlined as opposed to everyone being rushed into it. There is also a need to change the definition of affordable housing from being ‘price-based’ to ‘area-based’. The land costs and cost of construction in general vary across India and cannot be pre-defined with a blanket policy approach. The current cap of ₹45 lakh is not practical for Tier 1 cities including Mumbai, and Delhi, among others, where the cost of land in itself is very high, so it becomes very difficult for developers to meet that criteria in these regions which is hampering the supply of affordable homes.

How is the industry embracing sustainable development and environmental impact of construction projects?

The industry is increasingly embracing sustainable development and environmentally friendly construction models and techniques. This is evident through the increase in the adoption of green building certifications issued by bodies like IGBC in India, which is judged on the use of eco-friendly materials, energy-efficient systems, and waste reduction and recycling practices. We, at CREDAI, also pledged to construct over 1 lakh green homes in collaboration with IGBC by 2025, to set a benchmark in sustainable development. CREDAI also cohosted a conference on emerging materials and technology in real estate with the Ministry of Housing and Urban Affairs, to lead the conversations on adopting such evolving models and setting a nationwide example for developers in the country.