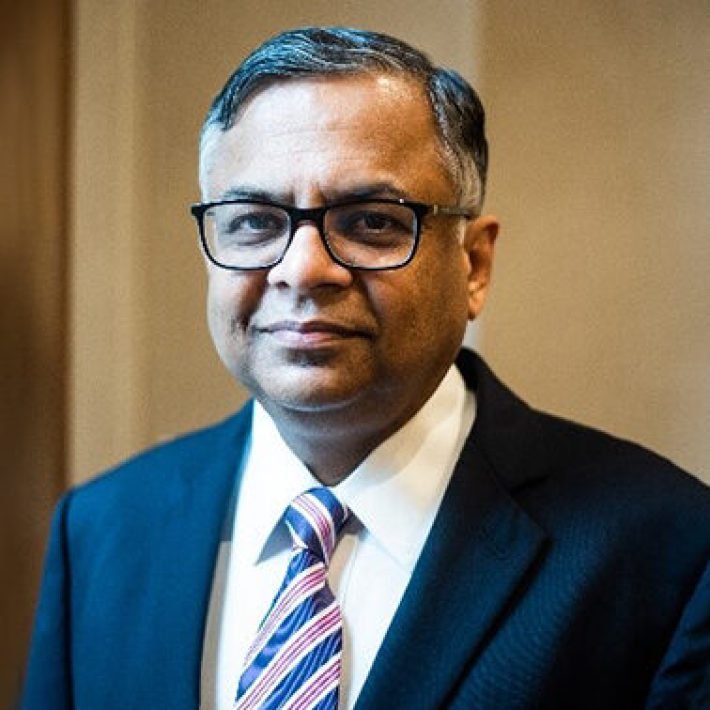

Dilip Shanghvi, Founder and Managing Director of India’s most valuable listed pharma outfit – Sun Pharmaceutical Industries, is one of the ‘most interesting and least understood business minds’.

By Nichola Marie

As a child, Dilip Shanghvi would watch his father, a wholesale drug distributor, at work in his small, wholesale medicine shop in the crowded Dawa Bazar market of Calcutta (Kolkata). Reading the drug labels, the young boy would wonder how they were made. Growing up, he decided he would go one step further and make medicines himself. It evidently mattered not that he was untrained in Science; soon after graduating in 1982 from the University of Calcutta with a Bachelor’s degree in Commerce, he borrowed ₹10,000 from his pharmaceutical dealer father. He used the sum — minuscule by most standards — to start Sun Pharmaceutical Industries in 1983, becoming its Managing Director.

Growth Spurt

In the beginning, Sun marketed only a modest number of psychiatric drugs. That changed by the early 1990s, as the company set up its own research and manufacturing facilities, while also adding cardiology and gastroenterology product lines. Shanghvi took the company public in 1994. Growing Sun through a series of rapid acquisitions, Sun Pharma made its first international conquest in 1997, when it bought the Detroit-based Caraco Pharmaceutical Laboratories. It then acquired equity stakes in two prominent Indian drug manufacturers, Tamilnadu Dadha Pharmaceuticals and MJ Pharmaceuticals. Under Shanghvi’s quiet, keen leadership, the company acquired more than a dozen companies and brands between 1999 and 2012. In 2010, after a three-year takeover battle, it purchased a controlling stake in Taro Pharmaceutical Industries; even better, it quickly doubled its US revenues to cross $1 billion. In 2015, Shanghvi engineered the completion of the company’s $3.2 billion acquisition of its rival generic-drug company Ranbaxy Laboratories from Japan-based pharmaceutical giant Daiichi Sankyo Co. This move propelled Sun Pharma to the position of fifth largest generic-drug producer in the world. Sun also thus became India’s largest pharmaceutical company. Interestingly, Sun earns 65% of its $5.1 billion annual revenue from overseas markets.

Challenges Overcome

Fiercely intense beneath his calm demeanour, in March 2015, Shanghvi beat Reliance Industries’ promoter Mukesh Ambani to become India’s richest man for a brief period. He would hold strong at the number two position, and even today is placed at number eight on the Forbes list of India’s richest. Not that the man on the street would guess it. Immensely uncomfortable with any reference to his riches, Shanghvi is known to be extremely work-focused and even introverted. Actively shunning public appearances including press conferences and parties, he works out of a simple office in Mumbai’s suburban Goregaon. And he never stops fighting quietly yet furiously to ensure the company, that he has built so painstakingly, invariably shines through the threatening clouds.

The company faced some of its most challenging times between 2014 and 2018. As an analysis in ‘Business Today’ elaborates, Sun Pharma, one of the largest generic drug players in the US, faced stiff pricing pressure which impacted it badly. Additionally, it faced FDA-related issues including warning letters, quality control and manufacturing deficiencies, and product recalls in the US. This obviously impacted its operations and market reputation, as well as growth and expansion plans. Its acquisition of Ranbaxy Laboratories in India in 2014 made Sun Pharma India’s biggest pharma company in 2015 but, as a result, its increased investments into a new business segment negatively impacted the company’s growth. As a result of regulatory issues, pricing pressure and increase in R&D spends, profits sank by 70% in FY18.

Down but definitely not out, Shanghvi responded with a bang. His new strategy of boosting the specialty drugs business (generally used to treat complex, chronic, or rare medical conditions), saw Sun growing 29% in US dollar terms in FY23. In the Indian market, he enhanced the company’s business by making investments in R&D, and focusing on improving competencies through mergers and acquisitions. By FY23, Sun had touched its highest-ever consolidated revenue of ₹43,279 crore and net profit of ₹8,474 crore.

Its M&A campaign saw it acquire US-based Ocular Technologies in 2016, giving it access to Seciera, a potential drug for treatment of dry eye disease. Sun Pharma later renamed and launched it as Cequa in 2019. It acquired the rights to sell the acne-treatment cream Winlevi, from Italy-based Cassiopea SpA, in the US and Canada markets in 2021. This May, it acquired the US-based Concert Pharmaceuticals for $576 million. This move gives it access to Concert’s experimental drug Deuruxolitinib, which is a potential treatment for alopecia areata. Previously, it acquired the Israel-headquartered Taro Pharmaceutical Industries in 2010 to access its dermatology generics portfolio and manufacturing facilities in Israel and Canada; DUSA Pharma, Massachusetts, in 2012 for its specialty drug-device dermatology combination; Ranbaxy for $4 billion; and US-based specialty ophthalmic company InSite Vision in 2015.

As a result, the global specialty business has brought in revenues of $871 million (around ₹7,147 crore) in FY23, a 29% y-o-y growth over $674 million in FY22. It has commercialised around 25 specialty products across the US, Canada, Europe, Japan, Australia, Israel and India, in the dermatology, ophthalmology and oncology segments. Expanding their field force to tier I and II towns is helping expand Sun’s geographical footprint.

Leagues Ahead

With consolidated revenues of ₹43,279 crore in FY23, Sun Pharma is leagues ahead of even its nearest competitor — Aurobindo Pharma which is in second place, at a distant ₹24,617 crore. Sun Pharma’s bottom line also increased a whopping 159% y-o-y to ₹8,474 crore in FY23 against ₹3,273 crore a year ago, which was largely due to a sharp fall in exceptional items or one-time expenditures. Interestingly, the company’s formula sees it building a presence in a market underpenetrated by bigger companies, even as it faces up to bigger rivals in traditional, non-specialty businesses such as generics.

Having successfully transitioned from concentrating solely on domestic branded generics to incorporating US generics or exports to emerging markets/rest of the world (ROW) markets, the company is well-poised for further growth.

With the 68-year-old billionaire from Dawa Bazar sharply steering his ship on the winning track, Sun Pharma looks set to comfortably navigate the unpredictable world of medicines for a long time to come. And when Shanghvi himself points out, “We continue to grow faster than the industry,” he is simply stating facts.

Knowing Dilip Shanghvi…

- He was born on October 1, 1955 in Amreli, Gujarat.

- His net worth is approximately ₹1,46,090 crore.

- Summing up the Sun Pharma philosophy, he said: “Our story is all about incremental growth. We’re not looking for big leaps; we prefer small jumps.”

- He is also known to be active as a personal investor, with interests extending into the realm of renewable energy.

- 2018 saw him becoming a member of the central board of the Reserve Bank of India.

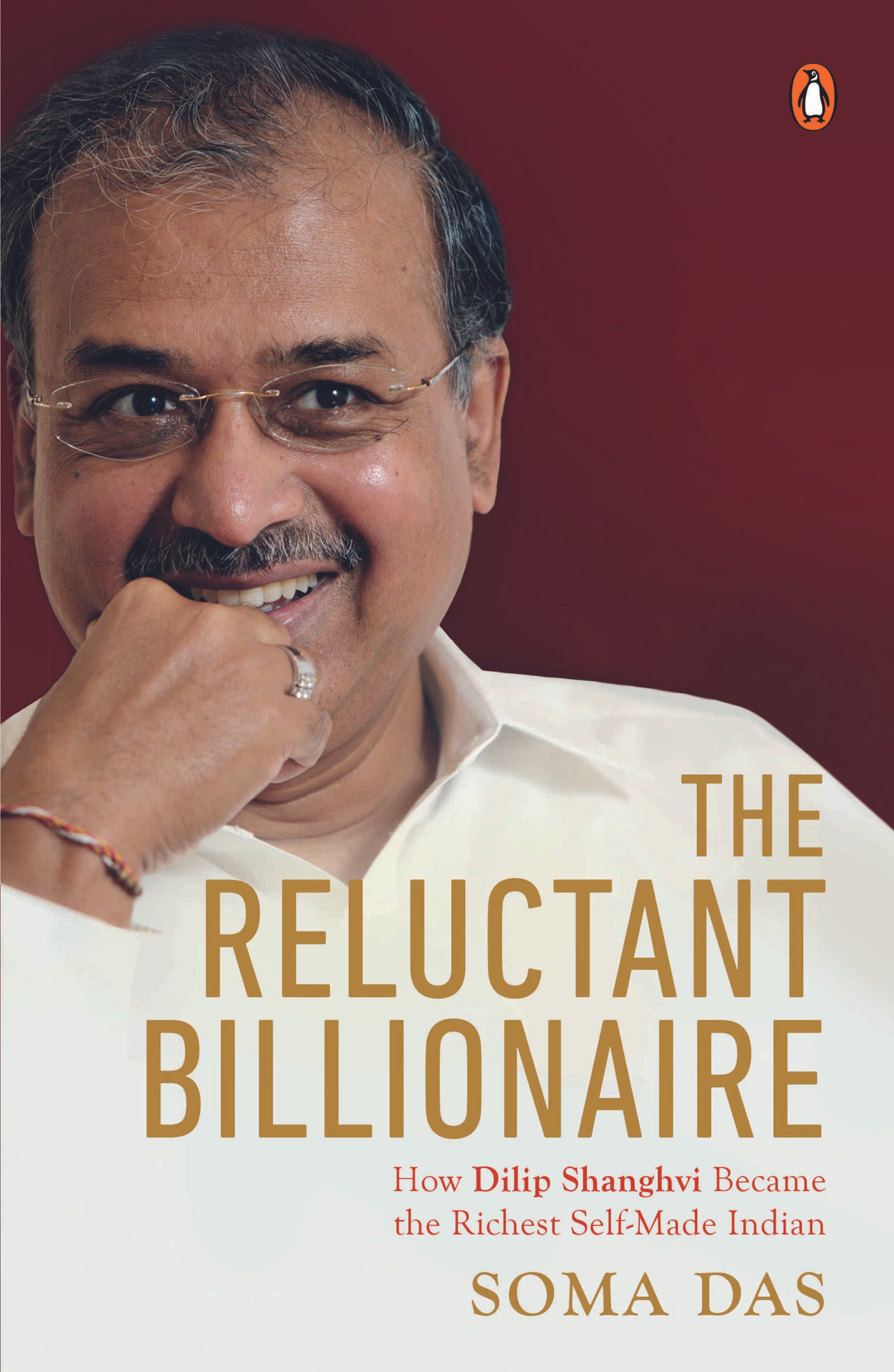

- Shanghvi’s biography by author Soma Das is fittingly titled ‘The Reluctant Billionaire: How Dilip Shanghvi Became the Richest Self-made Indian’. It is based on interviews with over 150 friends, extended family members, rivals, former aides, and business associates.

- Honours he has won include the Padma Shri in 2016 for his distinguished contribution to Indian trade & industry; a presence on ‘India Today’ magazine’s annual power list of 50 influential personalities in India in 2020 and 2021; Entrepreneur of the Year by All India Management Association (2017); NDTV Business Leader of the Year (2015); Forbes Entrepreneur for the Year (2014), Economic Times’ Business Leader of the Year (2014), CNN IBN’s Indian of the Year – Business (2011), Business India’s Businessman of the Year (2011), Ernst and Young’s World Entrepreneur of the Year (2011), Economic Times’ Entrepreneur of the Year (2008), Business Standard’s CEO of the Year (2008), and CNBC TV 18’s First Generation Entrepreneur of the Year (2007).

- Married to Vibha Shanghvi, they have a son, Aalok and a daughter, Vidhi, who work for Sun Pharmaceuticals. Aalok Shanghvi, who holds an undergraduate degree in Cellular and Molecular Biology from the University of Michigan, is Executive Director of Sun Pharma. He joined the company in 2006 as a product manager, and handled various roles in marketing, R&D and project management. In 2010, he headed Bangladesh and, by 2014, he took over the emerging markets business, spread across 80 countries covering Africa, the Middle East and other regions.

- In 2018, Vidhi Shanghvi was introduced as head of the Sun Pharma consumer healthcare business. The previous year, she married Vivek, son of Ranjana and Shiv Salgaocar of the VM Salgaocar business clan from Goa.