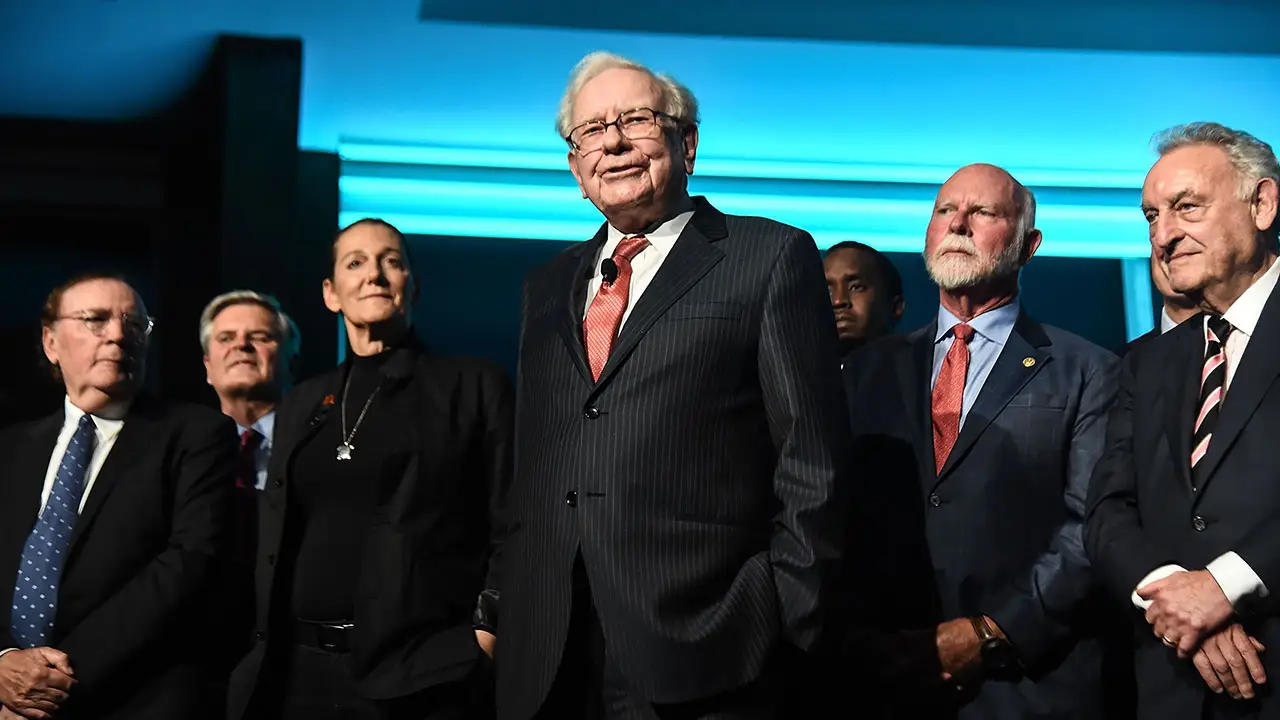

Defying prevailing investment trends to amass an astounding fortune, American businessman, investor and Chairperson/ CEO of Berkshire Hathaway – Warren Buffett’s real achievement is in the realm of philanthropy.

By Nichola Marie

When the ‘Oracle of Omaha’ and one of the most successful investors of all time – Warren Buffett shocked the world in 2006 by pledging to give away nearly all of his enormous fortune to charity, he owned 474,998 class A shares in his company Berkshire Hathaway, then worth around $43 billion. Since then, Buffett has donated more than $55 billion worth of his Berkshire Hathaway to charity, along with a $5.3 billion gift in late June. Had he been less inclined towards giving, his shares and personal investments would have ensured him a fortune of around $293 billion. …A sum that would make him approximately $41 billion richer than the world’s current richest man, Elon Musk!

As the man himself once pointed out: “Society has a use for my money – I don’t.”

The Gift Of Giving

Buffett’s success with Berkshire Hathaway made him one of the world’s wealthiest men, but he has consistently avoided lavish spending and also criticised governmental policies and taxation that favoured the rich over the middle or lower classes. He has written several times about his belief that, in a market economy, the rich earn outsized rewards for their talents. His children will not inherit a significant proportion of his wealth; as he once commented, “I want to give my kids just enough so that they would feel that they could do anything, but not so much that they would feel like doing nothing.”

Famously frugal — the 93-year-old Buffett even lives in the same Omaha, Nebraska, home he purchased in 1958 for $31,500 — he has been working to donate more than 99% of his fortune. This mainly happens through a summer tradition of donations worth billions of dollars from his stash of stock to five handpicked foundations. With each year’s gift being 5% fewer shares than the previous year’s, he once clarified, “My family and I will give up nothing we need or want by fulfilling this 99% pledge… I will continue to live in a manner that gives me everything that I could possibly want in life.”

The largest chunk of Buffett’s gifts has gone to a trust that funds the Bill & Melinda Gates Foundation, which has received stock worth more than $43 billion. The money has been used for poverty and healthcare initiatives in developing countries, as well as education and economic mobility in America. In 2010, Buffett co-founded The Giving Pledge alongside the Gateses to encourage other billionaires to donate at least half their fortunes to charitable causes as well. Buffett stepped down as a trustee of the Gates Foundation in 2021.

Buffett’s three children and the Susan Thompson Buffett Foundation — named for his late wife — have received the rest of the shares as gifts for the charities of their choice. More than $4.8 billion worth of shares went to the foundation named for his late wife, which focuses on healthcare and education. Following her death in 2004, her estate gave at least $2.9 billion to the foundation. Buffett has given more than $8 billion in total (at the time of his gifts) to his children’s three charities, namely the Sherwood Foundation, the Howard G. Buffett Foundation and the NoVo Foundation.

Decades of giving have seen Buffett reduce his Berkshire stake to 207,963 class A shares, which are still worth around $128 billion. He will continue to gift stock to the five foundations every year. He has also revealed that once he passes, the remainder of the Buffett fortune will go almost entirely to a charitable trust overseen by his children, rather than mainly to the Gates Foundation, as previously surmised. In totality, Buffett and the executors of his estate will have moved more than 99% of his wealth to charity.

Making Of A Legend

Born on August 30, 1930 in Omaha, Nebraska, US, Buffett was the son of US congressman Howard Homan Buffett from Nebraska. His interest in business and investing became apparent at a young age. At age seven, he was inspired by a book he borrowed from the Omaha public library titled, ‘One Thousand Ways To Make $1000’. His early childhood years were marked by entrepreneurial ventures including selling chewing gum, Coca-Cola, and weekly magazines door-to-door, as well as working in his grandfather’s grocery store. He was just 11 when he bought his first stock and he filed taxes for the first time aged 13. His father also helped educate and cultivate his budding interest in business and investing. While in high school, he invested in a business owned by his father and bought a 40-acre farm with his savings. By the time he finished college, he had reportedly amassed $9,800 in savings.

Graduating from the University of Nebraska (BS, 1950), he was rejected from Harvard Business School and instead got a master’s in economics from Columbia University.

Journey To The Top

Returning to Omaha in 1956, in 1965 he took majority control of the textile manufacturer Berkshire Hathaway Inc. Founded in 1839, it transitioned into a major conglomerate under the management of Chairman and CEO Buffett and Vice Chairman Charlie Munger.

Buffett would turn this into his primary investment vehicle. His success with Berkshire Hathaway made him one of the world’s wealthiest men; from the 1960s through the 1990s the major stock averages rose by approximately 11% per year, even as Berkshire Hathaway’s publicly traded shares gained around 28% each year.

Since 1970, Buffett has presided as the Chairman and largest shareholder of Berkshire Hathaway, which is credited with being one of America’s foremost holding companies and the world’s leading corporate conglomerates. It controls over 60 firms, with its earning power diversified across a broad portfolio of subsidiaries, equity positions and other securities. Insurance is a major area of operations and the float (the retained premiums) generated serves as an important source of capital.

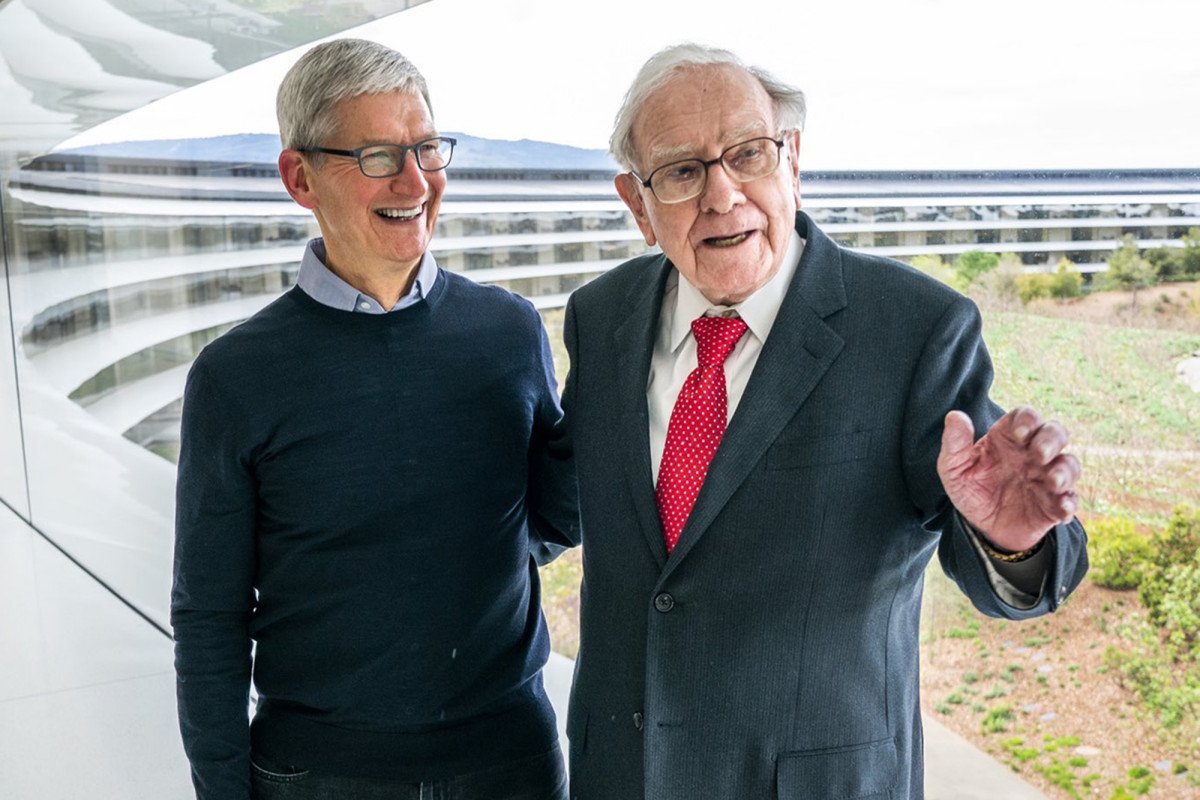

The company’s insurance brands include auto insurer GEICO and reinsurance firm Gen Re. Its non-insurance subsidiaries operate in diverse sectors such as confectionery, retail, railroads, home furnishings, machinery, jewellery, apparel, electrical power and natural gas distribution. Among its partially owned businesses are Kraft Heinz (26.7%), American Express (18.8%), Bank of America (11.9%), The Coca-Cola Company (9.32%) and Apple (5.57%). One of the top 10 components of the S&P 500 index, it is also one of the largest American-owned private employers in the United States.

Buffett’s multiple deals made during the subprime mortgage crisis of 2007-2008 raised eyebrows at the time; however, they went on to prove extremely lucrative. If he invested $5 billion in Goldman Sachs Group Inc in September 2008, a month later his company bought $3 billion in General Electric Company preferred stock. The following year, his company bought railroad company Burlington Northern Santa Fe Corporation for approximately $26 billion; Berkshire had owned around 23% of the railroad.

Investment Approach

One of the wealthiest people in the world, Buffett amassed his fortune through a successful investment strategy. He has constantly supported prolonged investment value over short-lived profits. He encourages investors for long-term funding of reputed establishments to obtain major profits over time. His investing style has been likened to that of a bargain hunter; it reflects his practical, down-to-earth attitude. A few pointers according to an analysis by ‘Investopedia’…

- Buffett follows the Benjamin Graham school of value investing which looks for securities with prices that are unjustifiably low based on their intrinsic worth.

- Buffett looks at companies as a whole rather than focusing on the supply-and-demand intricacies of the stock market.

- Some factors Buffett considers include company performance, company debt, and profit margins.

- Other considerations for value investors like Buffett include whether companies are public, how reliant they are on commodities, and how cheap they are.

That said, Buffett believes, “By far the best investment you can make is in yourself.” As Lynn Smith points out, Buffett often repeats his motto: To stand out, you must improve yourself to the point where others can’t ignore you. This means going above and beyond to become excellent at your craft through continuous learning and growth. For employees, he advises becoming indispensable at your job by being the absolute best. It involves learning everything about your role, industry, and company so you’re a valued expert.

Entrepreneurs should ensure their products or services are superior to competitors so customers have no other choice. They need to offer something special that makes them the only option worth considering. Buffett believes we need to invest substantial time, energy, and effort in developing our talents and skills if we want to succeed.

Buffett – The Man

- He often plays the ukulele — an instrument he picked up as a teenager, to try and win the attention of a young woman he had a crush on — at stockholder meetings and other opportunities.

- In 1952, he married Susan Thompson at Dundee Presbyterian Church. Parents to Susan Alice, Howard and Peter, the couple began living separately in 1977, although they remained married until Susan Buffett’s death in July 2004. In 2006, on his 76th birthday, Buffett married his longtime companion, Astrid Menks, who was then 60 years old — she had lived with him since his wife’s departure to San Francisco in 1977. Susan had reportedly arranged for the two to meet before she left Omaha to pursue her singing career. All three were close and Christmas cards to friends were signed ‘Warren, Susie and Astrid’.

- Passionate about Bridge, Buffett has shared, “Bridge is such a sensational game that I wouldn’t mind being in jail if I had three cellmates who were decent players and who were willing to keep the game going 24 hours a day.” He is also a lifelong follower of Nebraska football.

- Among the many honours he has been bestowed, is the Presidential Medal of Freedom (2011).